GST increase Singapore 2022

What is GST how it works. GST stands for Goods and Services Tax.

It was announced in the 2018 Budget that this rate would be increased to 9 sometime between 2021 and 2025.

. There will be live television and radio coverage of the Budget Statement and a live webcast of its delivery will be available on the Singapore Budget websiteIt will also be published on the website after delivery. 2500 Elderly who cant afford to retire. On top of these abovementioned areas we should expect to incur higher expenses not only due to inflation but also because of the planned increase in Goods and Services Tax GST.

The Inland Revenue Authority of Singapore IRAS will be revising the Annual Values AVs of HDB flats upwards by 4 to 6 with effect from 1 January 2022 in line with the increase in market rentals. The tariff for households will go up from 2411 cents to 2544 cents per kWh for the quarter ending Mar. Covid-19 Pandemic developments have been the markets main driver for almost two years causing a crash in 2020 and then a sustained rally on the back of vaccination programs that allowed an economic reopening.

The only exemptions are for the sales and leases of residential properties importation and local supply of investment precious metals and most financial services. Export of goods and international services are. The Centres notification to hike GST rates for several textile and apparel items from January 2022 has come as major blow to micro small and medium-scale textile and clothing units with.

PM Lee noted that Singapore needs a vibrant economy to generate the resources to realise its goals and the government must have reliable and adequate revenues to carry out its social programmes. Singapores economic recovery from the pandemic has been faster than what the economists predicted at the start of 2021. 2 days agoHe also gave a hint that the upcoming increase in the Goods and Services GST tax will be tackled in Budget 2022 which will be unveiled on Feb 18.

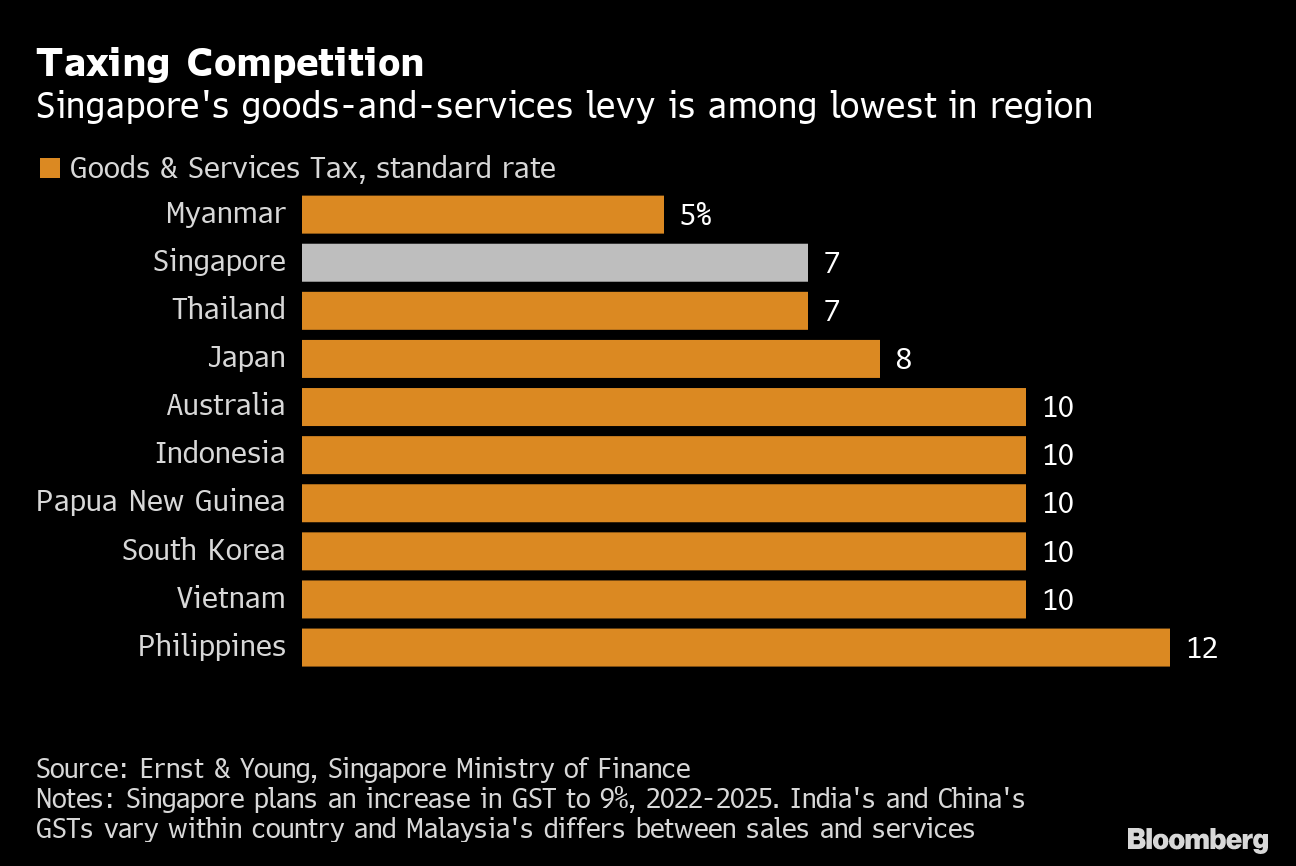

The tax structure is much simpler and easier to understand. Rate of taxation When it comes to GST vs VAT tax VAT is typically higher than GST. First announced in the Budget 2018 GST is expected to increase from 7 to 9 from 2022 to 2025.

GST is charged at 7 on the supply of goods and services made in Singapore by a taxable person in the course or furtherance of ones business and the importation of goods into Singapore. 1 day agoWith Singapores economy emerging from the Covid-19 pandemic the Government has to start moving on the planned increase in the Goods and Services Tax GST from 7 per cent to 9 per cent Prime. 3929 The future of employment and the Singapore job market.

They have also pegged Singapores benchmark Straits Times Index STI at a year-end target of 3550 points for the FY2022. SINGAPORE - The plan to raise the goods and services tax GST between next year and 2025 remains unchanged Finance Minister Lawrence Wong. The rate will be 2722 cents.

3130 The new norm. What trends will persist in 2022. Government Social Safety Net.

Whereas the rate of VAT in the UK is 20 the rate of GST in Australia Singapore and Canada is 10 7 and 5 respectively. It can also be served as a show-cause notice to a GST practitioner for. GST PCT 2 This form is a certificate of enrolment which is issued by an authorized officer for you to be able to start work as a GST practitioner.

GST in Singapore is a broad-based value added tax levied on import of goods as well as nearly all supplies of goods and services. The AV revision is part of IRAS annual review of properties to compute the property tax payable. GST To Increase After 2022.

2 days agoFirst announced in 2018 the increase in GST from 7 per cent to 9 per cent is meant to help Singapore meet rising recurrent spending needs especially in. Exempttax-free items Its also worth noting that some goods which are exempt from VAT may not be exempt from GST and vice. 2 days agoThe government had previously said that the GST increase - by 2 percentage points to 9 per cent - would take place at some point between 2022 and 2025 with the expectation to implement it sooner.

SINGAPORE Finance Minister Lawrence Wong will deliver Singapores FY2022 Budget Statement on Friday 18 February 2022 in Parliament. GST PCT 3 This form is a notice that seeks additional information from a GST practitioner on the enrollment application. Getting the details right in 2022 will be no easier -- but a few broad themes are likely to persist.

The Government will have to start moving on the planned hike in Goods and Services Tax GST in Budget 2022 given that the economy is. The Goods and Services Tax GST implemented on July 12017 is regarded as a major taxation reform till date implemented in India since independence in 1947. GST is a destination based tax as against the present concept of origin based tax.

2100 Helping your fellow Singaporean. Even with the impact of the heightened alert measures in July and August the economy expanded by 71 year over year and 13 quarter over quarter in the third quarter. 31 2022 before factoring in Goods and Services Tax GST.

4225 What will 2022 be like for you. According to a report by the National Council of Applied Economic Research GST is expected to increase economic growth by between 09 per cent and 17 per cent. Electricity tariff for households to increase by 56 for the first quarter of 2022.

It is an Indirect tax which introduced to replacing a host of other Indirect taxes such as value added tax service tax purchase tax excise duty and so onGST levied on the. Excluding Goods and Services Tax GST the tariff for households will go up from 2411 cents to 2544 cents per kWh for the quarter ending Mar. On this the analysts say they are positive on the outlook for Singapore and Thailand with both countries likely to outperform in 2022 due to accelerating growth on the reopening of borders.

SINGAPORE As Singapores economy emerges from Covid-19 the Government has to start moving on the planned increase in the Goods and Services Tax GST from 7 per cent to 9 per cent said. Goods and Services Tax Abbreviation.

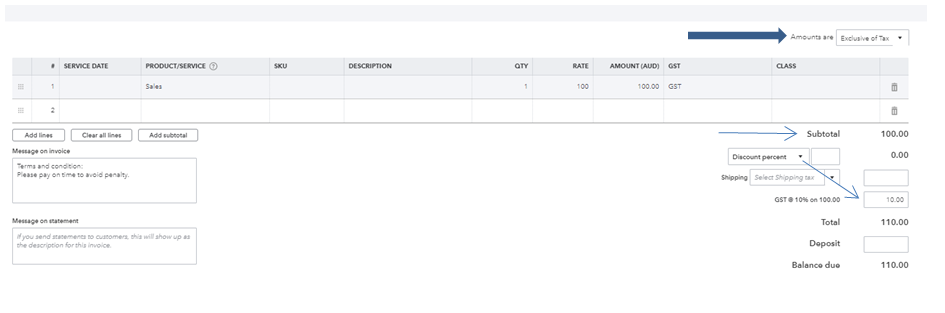

Solved What Is The Difference Between Tax Exclusive And T

The Gst Tax Rate Structure In India Download Table

Retail 16000 Fire Sale 10000 Wire New Rolex Black Dial 31mm Oyster Perpetual Date Just With Yellow Gold And Diamonds Come Rolex New Rolex Oyster Perpetual

Gst Singapore A Complete Guide For Business Owners

Gst Singapore A Complete Guide For Business Owners

Singapore Boosts Spending To Counter Virus Economic Threats

Gst Singapore A Complete Guide For Business Owners

What India Can Learn From Failure Of Malaysia S Gst

Gst Singapore A Complete Guide For Business Owners

India Number Of Gst Taxpayers In India 2020 By State Statista

Corporate Travel Corporate Travel Booking Hotel Vacation Packages

What India Can Learn From Failure Of Malaysia S Gst

46th Gst Council Meet On Dec 31 To Discuss Rate Rationalisation The Economic Times